Norges Bank

View:

May 03, 2024

Norges Bank Review: Even More Caution?

May 3, 2024 8:46 AM UTC

Surprising few, the Norges Bank Board left the policy rate at 4.5% for a third successive meeting at its latest Board meeting. It also retained the thinking first aired at the December meeting, namely ‘policy to stay on hold for some time ahead’ rhetoric, this more formally evident in what wer

April 25, 2024

Norges Bank Preview: Nothing New to Note?

April 25, 2024 9:29 AM UTC

Surprising few, the Norges Bank Board is very likely to leave its policy rate at 4.5% for a third successive meeting when it gives it next verdict on May 3. It is also likely to retain the thinking first aired at the December meeting, namely the ‘policy to stay on hold for some time ahead’ rhe

March 22, 2024

Western Europe Outlook: Easing Cycle Underway?

March 22, 2024 11:26 AM UTC

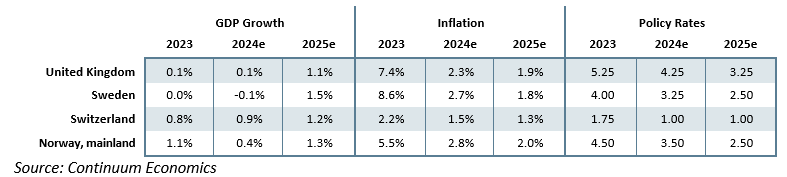

· In the UK, downside economic risks may have dissipated but the tighter monetary stance has far from fully bitten. This accentuates and/or prolongs an already weak domestic backdrop into 2025 that will complement friendlier supply conditions in easing inflation. The BoE will likely e

March 21, 2024

Norges Bank Review: Unrevised Rate Cutting Hints?

March 21, 2024 10:10 AM UTC

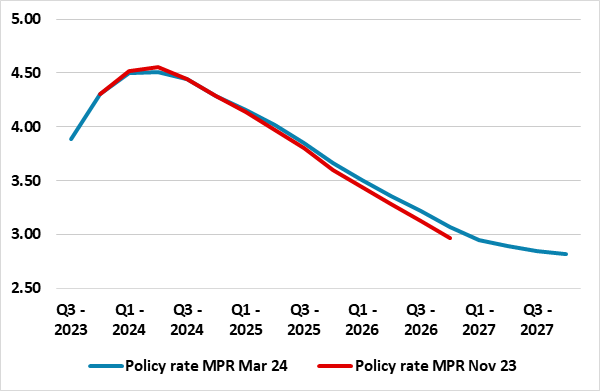

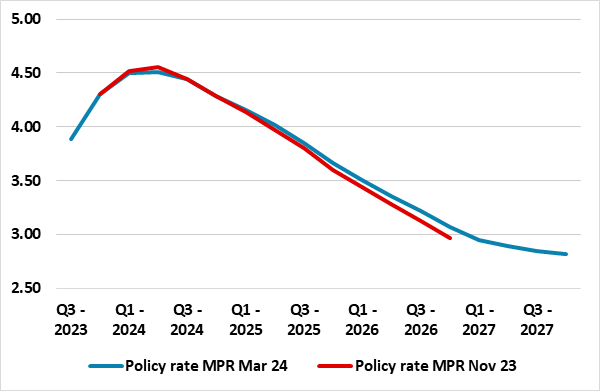

Surprising few, the Norges Bank Board left the policy rate at 4.5% for a second successive meeting and even retained the thinking first aired at the December meeting, namely the ‘policy to stay on hold for some time ahead’ rhetoric. It accepted a softer recent inflation backdrop but revised up

March 18, 2024

Sweden Riksbank Preview: Early Easing Discussion Clearer But Nothing Definitive

March 18, 2024 4:20 PM UTC

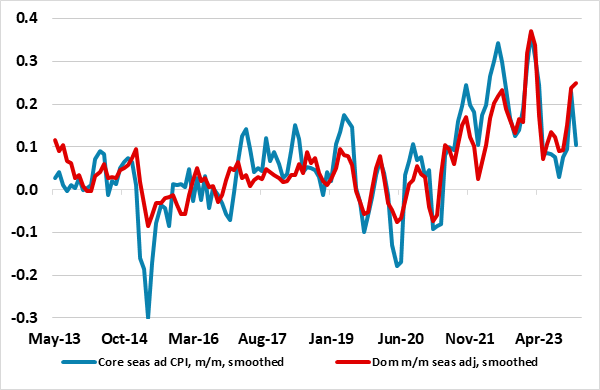

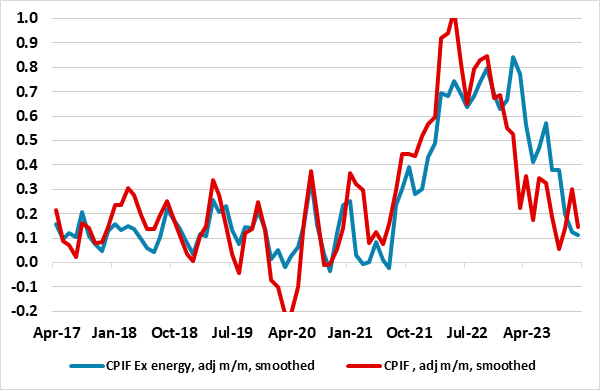

It is ever clearer that the Riksbank has accepted that it can and should make its policy stance less contractionary, at least in conventional terms. In its last decision, at the start of February, keeping policy at 4%, albeit increasing the pace of bond sales from SEK 5 billion to 6.5 billion per

March 12, 2024

Norges Bank Preview: Clearer Rate Cutting Hints?

March 12, 2024 10:26 AM UTC

Unlike, January’s Norges Bank meeting, the decision(s) due on Mar 21 will be far from a non-event. The Board will surely leave rates on hold for a second successive meeting, and may even retain the thinking first aired at the December meeting, namely the ‘policy to stay on hold for some time a

February 13, 2024

Switzerland: Disinflation - Fanned by the Franc

February 13, 2024 11:14 AM UTC

It is somewhat ironic that the sharp and surprising slump in CPI inflation in January resulted in a weakening of the Franc, the currency’s recent and still clear strength actually the major factor behind this seemingly clearer disinflation. Indeed, the CPI details showed the major factor was eve

February 01, 2024

Sweden Riksbank Review: Easing Flagged as Policy Can be Less Contractionary

February 1, 2024 9:22 AM UTC

It is ever clearer that the Riksbank now accepts that it can and should make its policy stance less contractionary, at least in conventional terms. In its latest decision, keeping policy at 4%, albeit increasing the pace of bond sales from SEK 5 billion to 6.5 billion per month, it noted that the

January 25, 2024

Norges Bank Review: Policy Unchanged, Rhetoric Unchanged

January 25, 2024 9:43 AM UTC

As was very much expected, this month’s Norges Bank meeting was something of a non-event. The Board left rates on hold, and also retained the thinking aired at the December meeting when it hiked rates somewhat surprisingly. There was a repetition of the ‘policy to stay on hold for some time ah

January 23, 2024

Sweden Riksbank Preview (Feb 1) Clearly Improving Inflation Picture Accepted?

January 23, 2024 3:07 PM UTC

It is ever clearer that the Riksbank has finished its hiking, this borne out by the unchanged policy decision last month and by the same decision due at policy verdict due on Feb1. The question now turns to policy easing. Recent data have continued to be been mixed, with slightly perkier tones to th

January 18, 2024

Norges Bank Preview (Jan 25): Marking Time

January 18, 2024 9:55 AM UTC

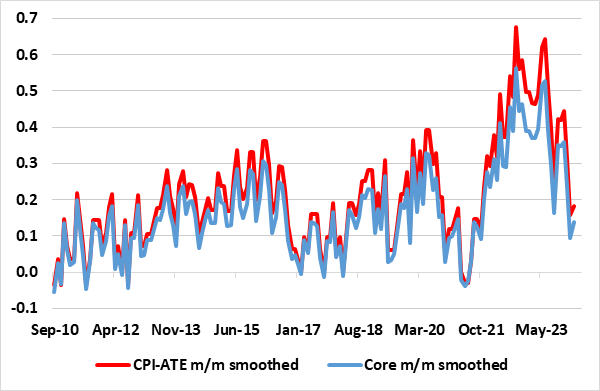

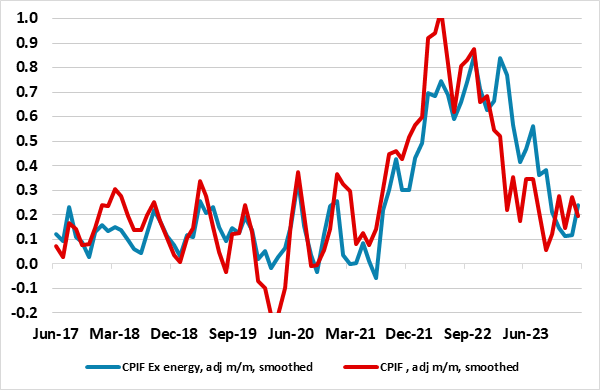

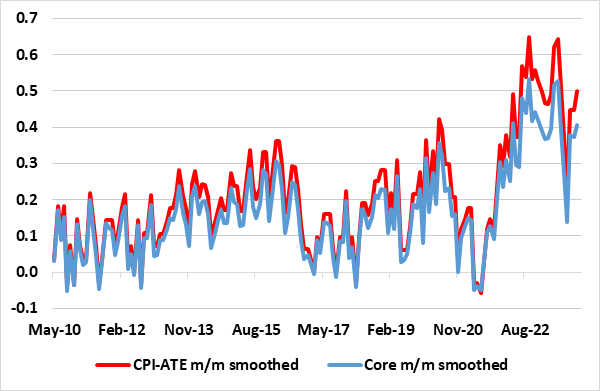

The Jan 25 Norges Bank meeting will be something of a non-event. The Board will leave rates on hold, this widely expected outcome coming after the latest slightly softer than expected but still resilient CPI data (Figure 1) and as-expected GDP numbers since the surprise hike last month. There will

December 15, 2023

Western Europe Outlook: Inflation Succumbing?

December 15, 2023 2:44 PM UTC

Our Forecasts

Risks to Our Views

Common Themes

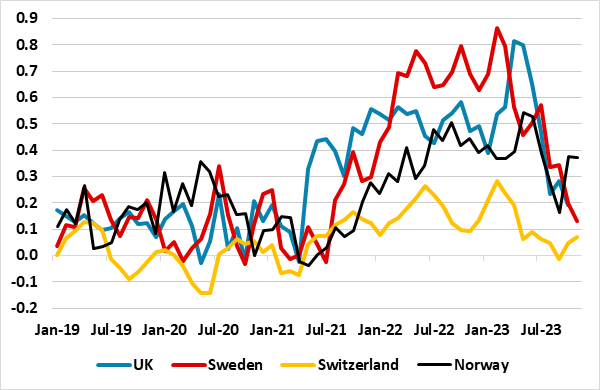

There continue to be clear cross currents across Western Europe’s economies that may continue into 2024 and possibly beyond, all inter-related. Firstly, while we have made little alteration to the 2024 outlooks for all four countries, they remain very

November 16, 2023

Long-term Forecasts to download in Excel

November 16, 2023 10:38 AM UTC

We present our annual forecasts that go out to 2030 for GDP Growth, Inflation, and Monetary Policy and to 2028 for Exchange Rates. The file contains five sheets: a Country Coverage summary page and a sheet for each of the four indicators.

The forecasts are consistent with the Long-term Forecasts: DM

Long-term Forecasts: DM Policy Easing

November 16, 2023 8:44 AM UTC

The Continuum Economics research team has spent much of the last month researching, reviewing and debating our long-term GDP, CPI inflation and central bank policy rate forecasts for 2025-30. Alongside a reassessment of long-term factors such as productivity and demographics, we have examined the la

November 02, 2023

Norges Bank Review: Finger Eases on Policy Trigger

November 2, 2023 9:31 AM UTC

Figure 1: Sizeable Output Gap Emerging

Source: Norges Bank

Policy Considerations

While the Bank suggests that the labour market is still tight, it acknowledges that pressures in the Norwegian economy are easing. It underscores the dilemma central banks obviously face, namely the longer inflation

September 27, 2023

Western Europe Outlook: Policy Peaking

September 27, 2023 9:50 AM UTC

Our Forecasts

Source: Continuum Economics, Office for National Statistics, Eurostat, Swiss Secretariat for Economic Affairs, Statistics Norway

Risks to Our Views

Source: Continuum Economics

A Riskier Score for 2024

There a several common themes across Western Europe’s economies that are evident at pres

September 21, 2023

Norges Bank Review: Finger Still on Policy Trigger

September 21, 2023 9:09 AM UTC

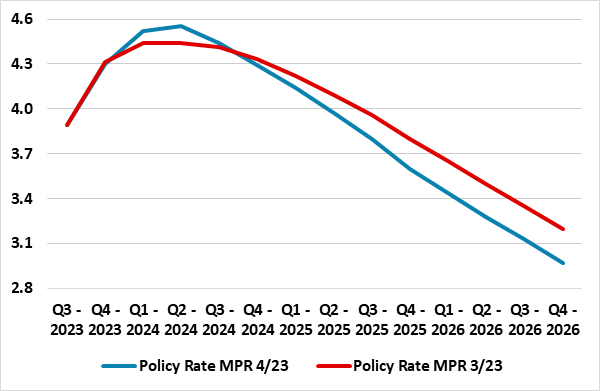

Figure 1: Official Rate Hike Profile Raised

Source: Norges Bank, last two Monetary Policy Reports

Policy Considerations

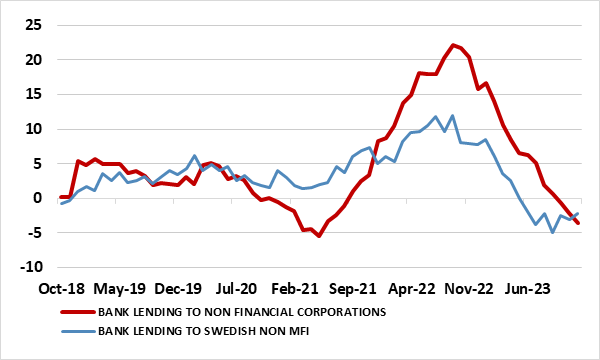

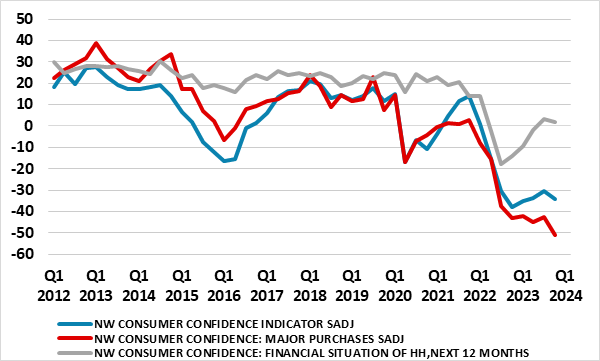

Evidence that policy tightening is biting is clear most particularly in what are very weak consumer confidence readings which do seem to reflect the impact of the policy rate at a

September 12, 2023

Norges Bank Preview: A Final Hike and Then…?

September 12, 2023 10:11 AM UTC

Figure 1: Official Rate Hike Path to be Retained?

Source: Norges Bank last two Monetary Policy Reports (MPR)

Financial Stability Considerations

Evidence that policy tightening is biting is clear most particularly in what are very weak consumer confidence readings which do seem to reflect the impa

August 17, 2023

Norges Bank Review: One More Hike?

August 17, 2023 9:07 AM UTC

Figure 1: Softer Mortgage Trends

Source: Norges Bank

Financial Stability Considerations Put to One Side

Evidence that policy tightening is biting is clear but hardly sizeable, even though this latest hike took the policy rate to a fresh 15-year high of 4.0% encompassing a 400 bp cumulative hike in the

August 07, 2023

Norges Bank Preview: Less Hawkish Tones?

August 7, 2023 10:52 AM UTC

Figure 1: Even Higher Hiking Path

Source: Norges Bank

Financial Stability Considerations

Evidence that policy tightening is biting is clear but hardly sizeable, even though the hike in June took the policy rate to a fresh 15-year high of 3.75% encompassing a 375 bp cumulative hike in the previous 1

June 22, 2023

Western Europe Outlook: Consumer Fragilities Persist

June 22, 2023 12:48 PM UTC

Our Forecasts

Source: Continuum Economics, Office for National Statistics, Eurostat, Swiss Secretariat for Economic Affairs, Statistics Norway

Risks to Our Views

Source: Continuum Economics

Despite the drop in energy prices (which means that the threat of immediate recession has been reduced), it is not

Norges Bank Review: Hawkish Overtones

June 22, 2023 9:19 AM UTC

Figure 1: Even Higher Hiking Path

Source: Norges Bank

Notably, the central bank highlighted that Inflation is markedly above the target. It has reservation sin both possible policy directions. If the krone turns out to be weaker than assumed or pressures in the economy persist, a higher-than-pro

June 14, 2023

Norges Bank Preview: A Probable Final Hike?

June 14, 2023 10:48 AM UTC

Figure 1: Higher Hiking Path Nearly Met?

Source: Norges Bank

Notably, the central bank last month did repeat the projection made in March that the policy rate will reach 3.5% sometime in the summer, this time specifically at the June 22 scheduled Board meeting. Implicitly this will also still poin

March 27, 2023

Western Europe Outlook: Valedictory Hiking?

March 27, 2023 3:16 PM UTC

Our Forecasts

Source: Continuum Economics, Office for National Statistics, Eurostat, Swiss Secretariat for Economic Affairs, Statistics Norway

Risks to Our Views

Source: Continuum Economics

We still see fully-fledged recessions in all but Switzerland but they are now envisaged to be shallower and shorte

February 22, 2023

In-Depth Research: Quick Roadmap Central Bank Forecast/Rationale - February 2023

February 22, 2023 10:44 AM UTC

M/T Quick Roadmap – Fundamental MMKT/CB Roadmap and Rationale

February 2023

US FEDERAL RESERVE

The February 1 December FOMC meeting saw the pace of tightening slowed to 25bps. Inflation has slowed, but January's CPI details still show broad based inflationary pressures at a pace well above the Fed's

July 06, 2022

Government Bonds: Inflation or Slowdown Risk?

July 6, 2022 2:36 PM UTC

Figure 1: G4 10yr Government Bond Yields (%)

Source: Datastream, Continuum Economics

Government Bonds Become Two-way

The one-way upward surge in DM government bond yields has finished for now, and government bond yields are torn between high inflation and slowdown/recession risks (Figure 1). The rece

June 17, 2022

Western Europe Outlook: Consumers Seeking Energy

June 17, 2022 10:16 AM UTC

Our Forecasts

Source: Continuum Economics, Office for National Statistics, Eurostat, Swiss Secretariat for Economic Affairs, Statistics Norway

Risks to Our Views

Source: Continuum Economics

Although rate hiking is now more commonplace, divergent monetary policy backdrops and outlooks among Western Europ