View:

May 08, 2024

China Equities: A Tactical Play

May 8, 2024 2:20 PM UTC

China equities can see a tactical bounce of 5-10% in the coming months. Cheap valuations and underweight global fund positions means that the scale of pessimism only has to get less bad on the economy and China authorities attitude towards businesses. While we see a tactical opportunity, we do

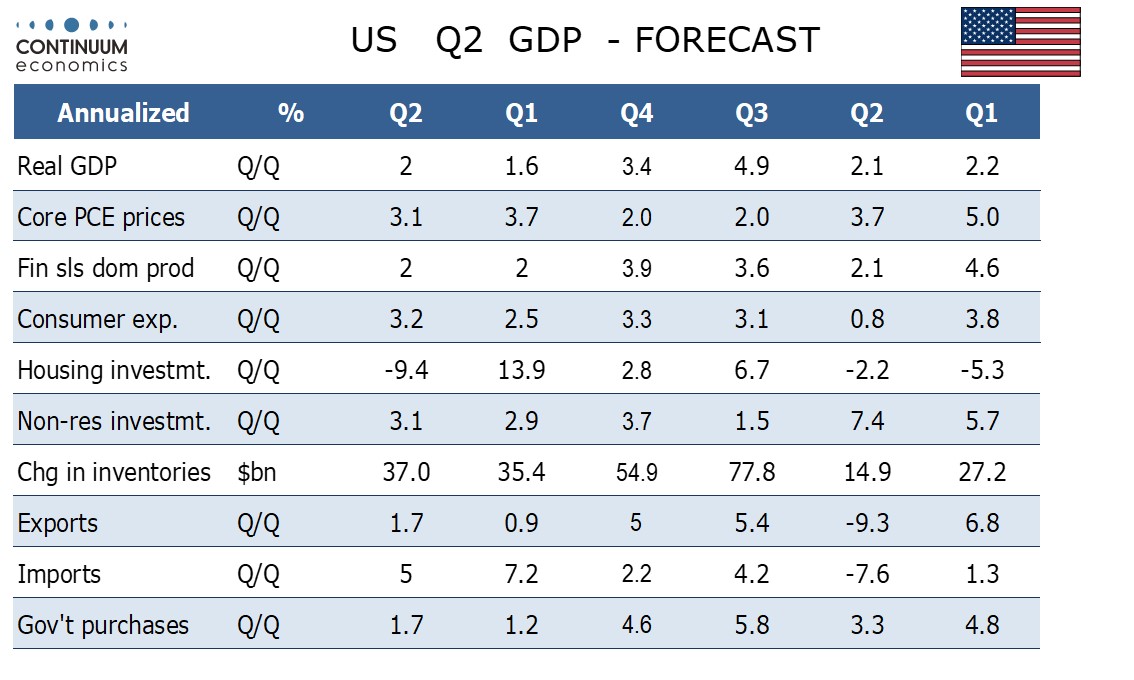

U.S. Q2 GDP to Increase by 2.0% Annualized Before Slowing In the Second Half

May 8, 2024 1:36 PM UTC

In our quarterly outlook on March 22 we looked for Q1 US GDP to rise by 2.4% annualized followed by growth of near 1.0% in the remaining three quarters. While Q1 at 1.6% came in weaker than expected details were constructive for Q2 for which we now expect a 2.0% annualized gain. We continue to expec

Ukraine War Update: Major Russian Offensive is Expected This Summer Despite U.S. Military Aid

May 8, 2024 12:06 PM UTC

Bottom Line: The offensives at the front lines started to pick up steam after March/April as the Russian forces plan for their larger summer 2024 offensive operation, aiming to seize more territory before the U.S. presidential elections in November. In the meantime, U.S. approved a $61 billion warti

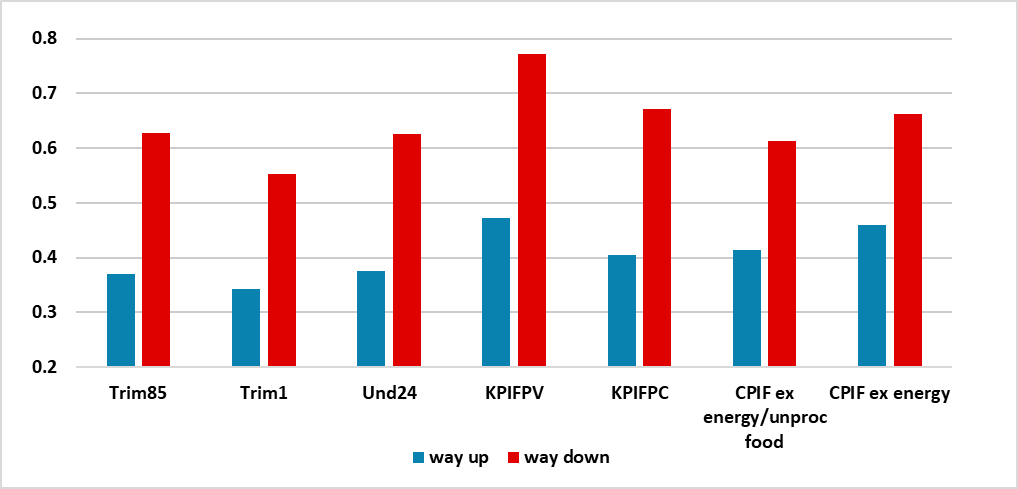

Sweden Riksbank Review: Biting the Bullet

May 8, 2024 8:24 AM UTC

It very much seemed to be a question of when, not if, as far as policy easing is concerned for the Riksbank. In this regard, albeit surprising in terms of timing, the Riksbank delivered, cutting its policy rate by 25 bp (to 3.75%), despite clear concerns it has flagged about recent and continued k

May 07, 2024

Indonesia Q4 GDP Review: Robust Start to 2024

May 7, 2024 1:22 PM UTC

Bottom line: Indonesia's Q1 GDP — released on May 6 — saw growth rebound to 5.1% yr/yr from 4.90% yr/yr in Q4 2023. While private consumption continued its ascent, government expenditure emerged as the key driver of Indonesia's growth narrative. Private consumption was supported by festive deman

U.S. Fiscal Problems: 2025 More Than 2024

May 7, 2024 1:10 PM UTC

Current real yields in the U.S. government bond market already large reflect the large government deficit trajectory. Even so, H1 2025 could see some extra fiscal tensions that add 30-40bps to 10yr U.S. Treasury yields as the post president election environment will either see a reelected Joe Bide