View:

FOMC Preview For May 1: Signaling Concern on Inflation, Tapering Quantitative Tightening

April 25, 2024 7:04 PM UTC

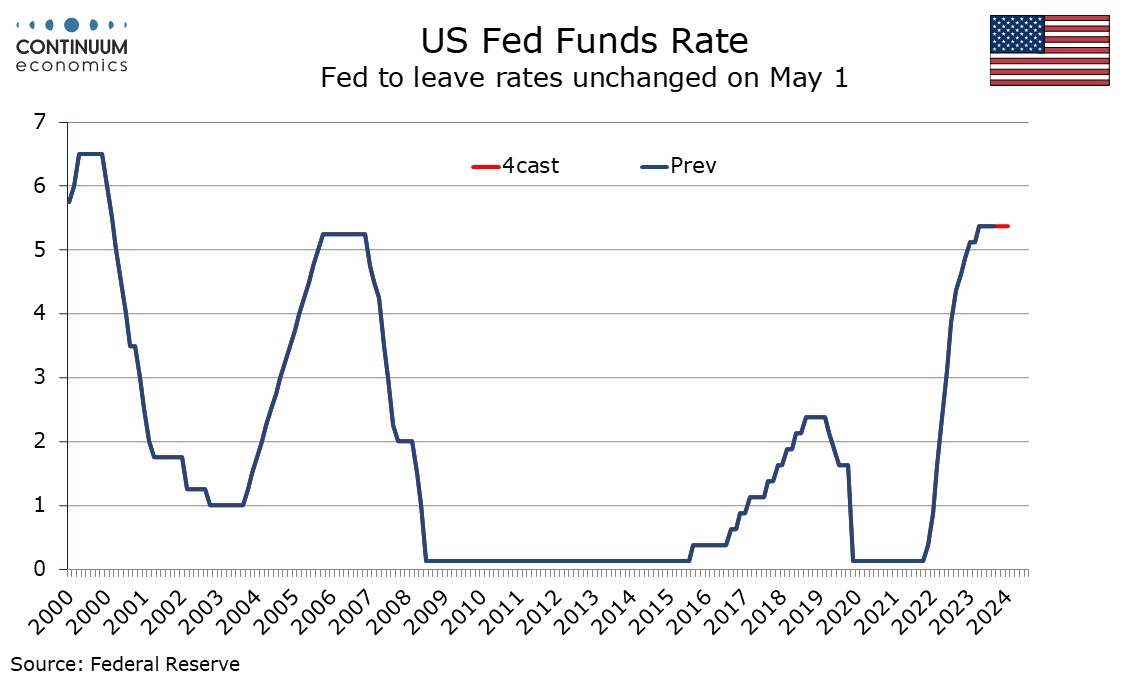

Bottom Line: The FOMC meets on May 1 and rates look sure to remain at the current 5.25%-5.50% target range. The statement is likely to see some adjustments to reflect recent disappointment on inflation while repeating that more confidence on inflation moving towards target is needed before easing. I

Bank of Canada Minutes Look to Gradual Easing, Divided on When to Start

April 24, 2024 6:44 PM UTC

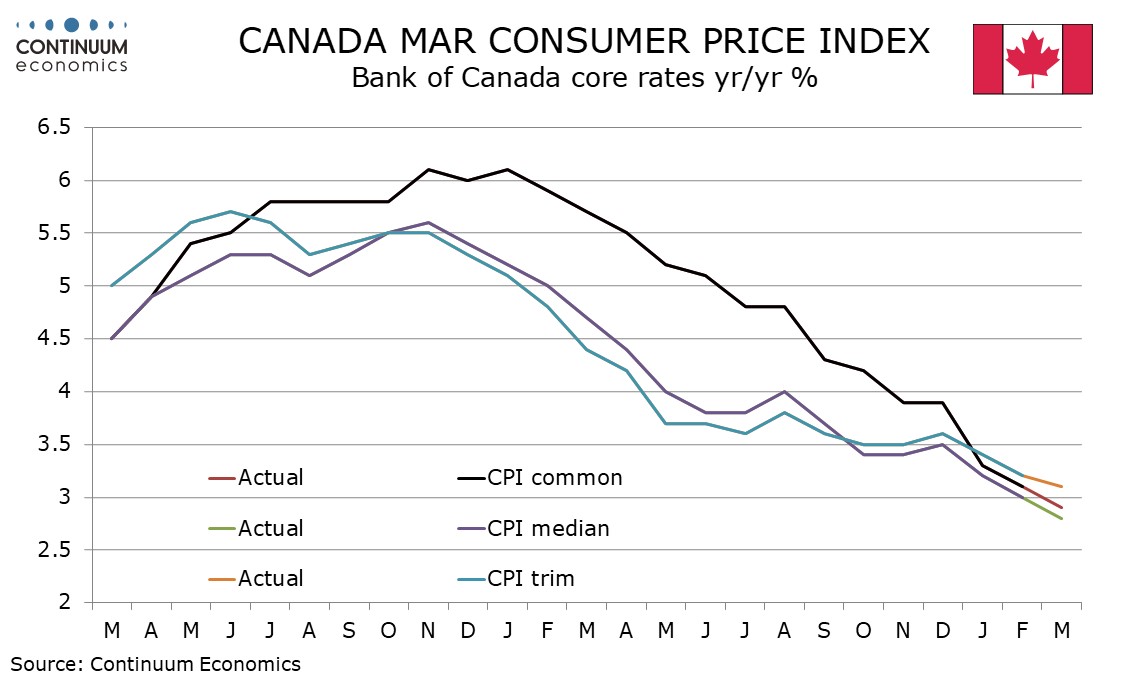

Bank of Canada minutes from the April 10 meeting confirm a greater confidence on inflation falling, though there is disagreement within the Governing Council over when policy easing will become appropriate. There was agreement that easing would probably be gradual given the risks to the outlook and

U.S. March Retail Sales allow Q1 to come in marginally positive despite a weak start in January

April 15, 2024 12:56 PM UTC

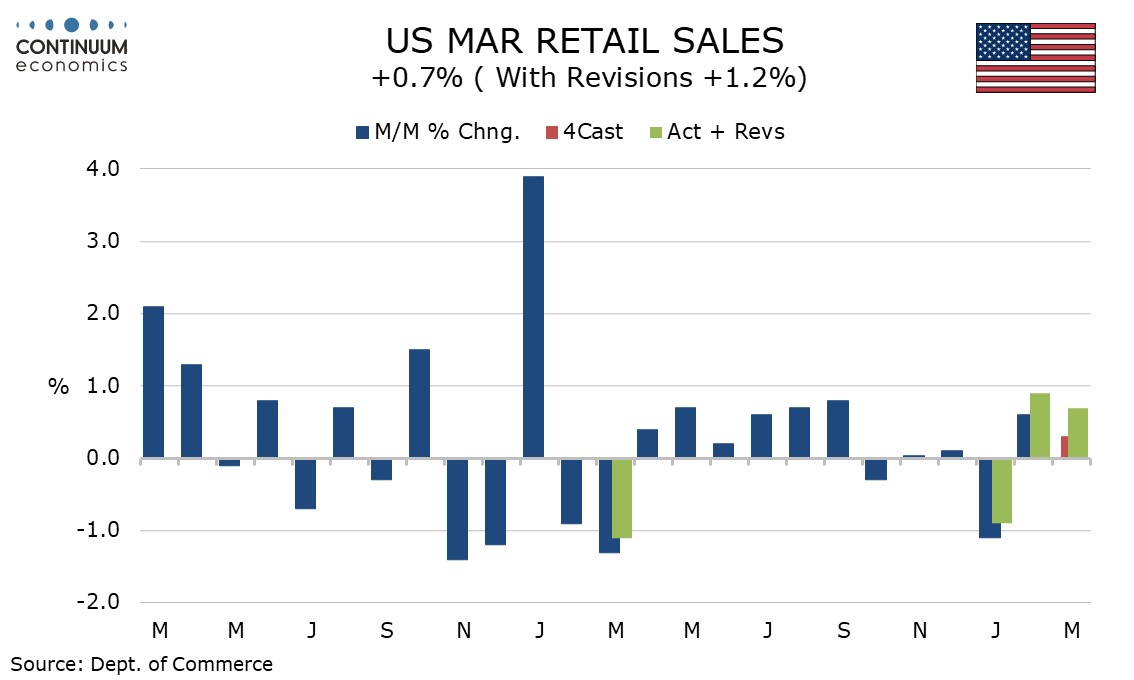

March retail sales with a 0.7% increase have exceeded expectations despite an expected negative contribution from autos, with sales up by 1.1% both ex autos and in the control group that contributes to GDP, and by 1.0% ex autos and gasoline. This suggest continued consumer momentum entering Q2.

Preview: Due April 16 - Canada March CPI - Correction after two soft months

April 15, 2024 1:22 PM UTC

We expect March Canadian CPI to move higher to 3.0% yr/yr from 2.8% in February and 2.9% in January, with the monthly data likely to look quite firm after two soft months. However we do expect some modest progress lower in two of the three BoC’s core rates.

China Equities: A Tactical Play

May 8, 2024 2:20 PM UTC

China equities can see a tactical bounce of 5-10% in the coming months. Cheap valuations and underweight global fund positions means that the scale of pessimism only has to get less bad on the economy and China authorities attitude towards businesses. While we see a tactical opportunity, we do

U.S. Q2 GDP to Increase by 2.0% Annualized Before Slowing In the Second Half

May 8, 2024 1:36 PM UTC

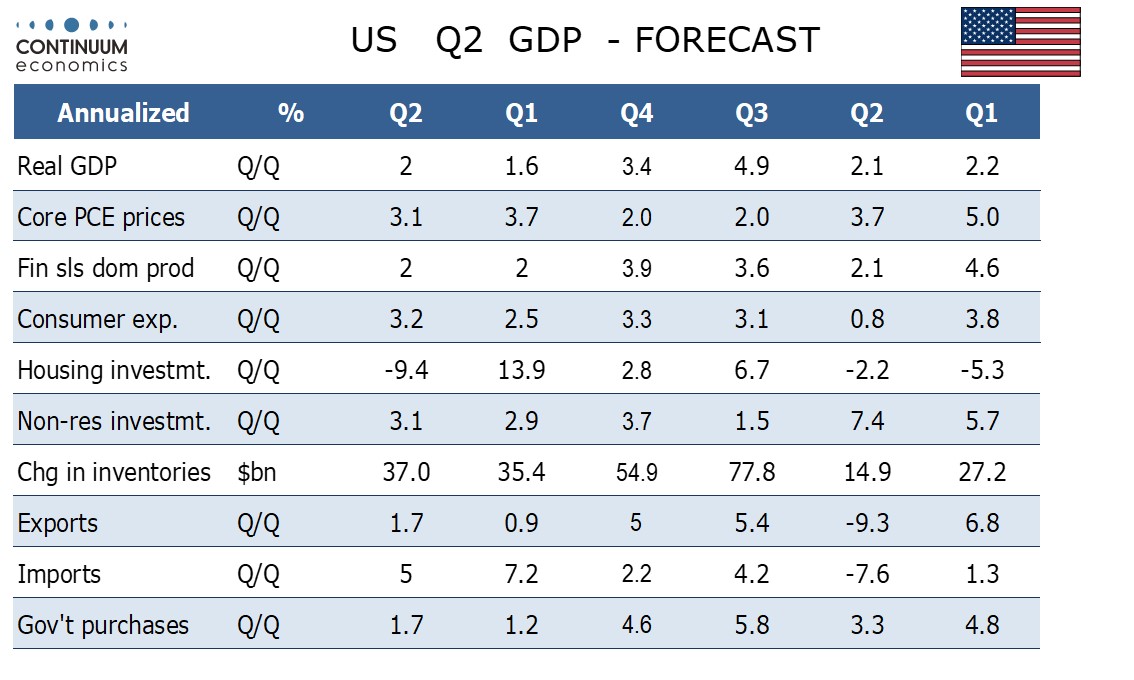

In our quarterly outlook on March 22 we looked for Q1 US GDP to rise by 2.4% annualized followed by growth of near 1.0% in the remaining three quarters. While Q1 at 1.6% came in weaker than expected details were constructive for Q2 for which we now expect a 2.0% annualized gain. We continue to expec

Ukraine War Update: Major Russian Offensive is Expected This Summer Despite U.S. Military Aid

May 8, 2024 12:06 PM UTC

Bottom Line: The offensives at the front lines started to pick up steam after March/April as the Russian forces plan for their larger summer 2024 offensive operation, aiming to seize more territory before the U.S. presidential elections in November. In the meantime, U.S. approved a $61 billion warti

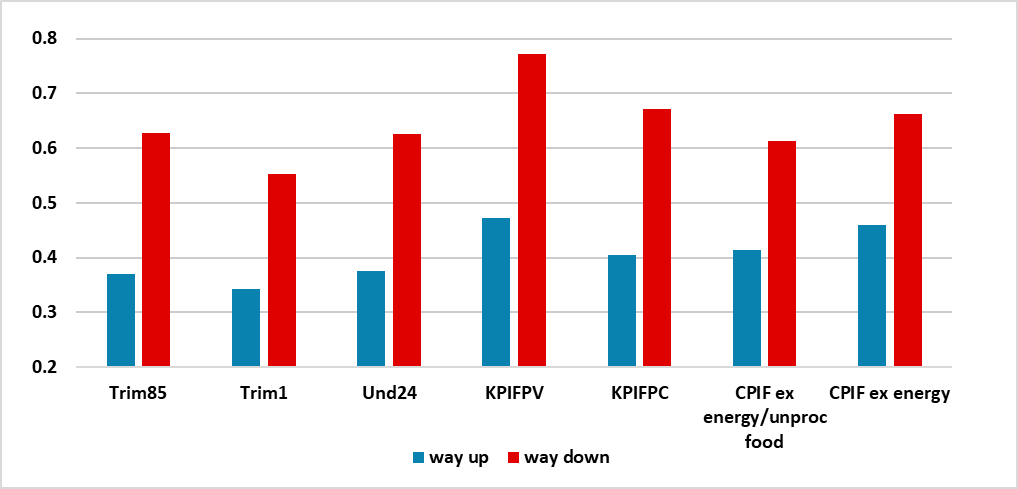

Sweden Riksbank Review: Biting the Bullet

May 8, 2024 8:24 AM UTC

It very much seemed to be a question of when, not if, as far as policy easing is concerned for the Riksbank. In this regard, albeit surprising in terms of timing, the Riksbank delivered, cutting its policy rate by 25 bp (to 3.75%), despite clear concerns it has flagged about recent and continued k