View:

May 08, 2024

China Equities: A Tactical Play

May 8, 2024 2:20 PM UTC

China equities can see a tactical bounce of 5-10% in the coming months. Cheap valuations and underweight global fund positions means that the scale of pessimism only has to get less bad on the economy and China authorities attitude towards businesses. While we see a tactical opportunity, we do

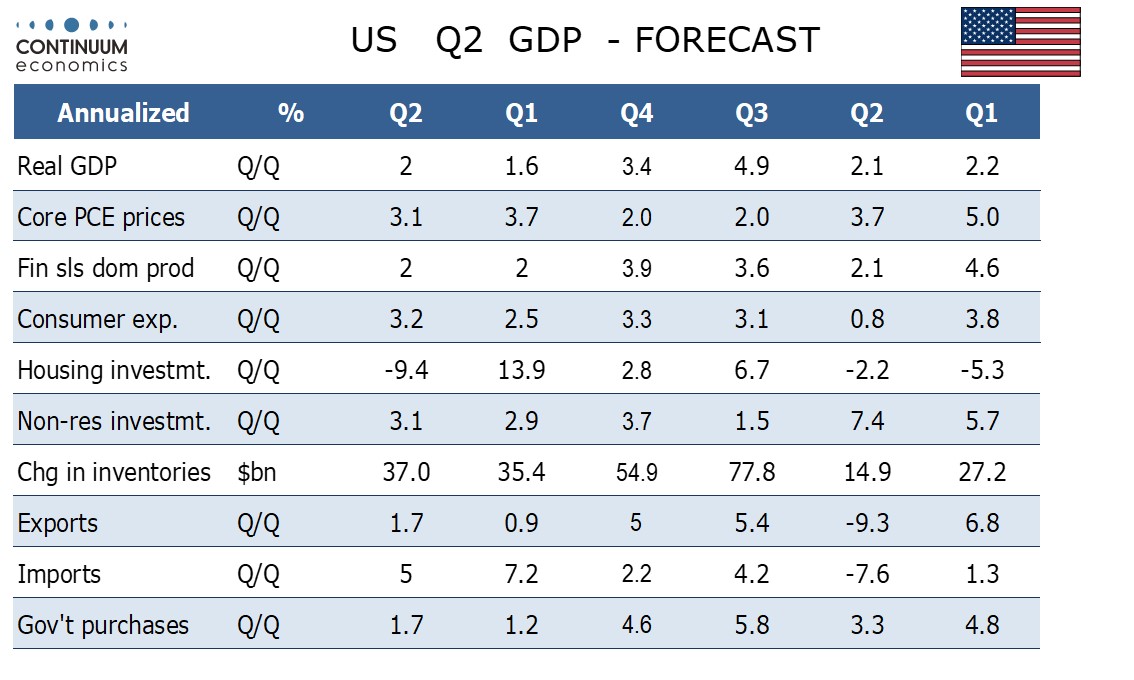

U.S. Q2 GDP to Increase by 2.0% Annualized Before Slowing In the Second Half

May 8, 2024 1:36 PM UTC

In our quarterly outlook on March 22 we looked for Q1 US GDP to rise by 2.4% annualized followed by growth of near 1.0% in the remaining three quarters. While Q1 at 1.6% came in weaker than expected details were constructive for Q2 for which we now expect a 2.0% annualized gain. We continue to expec

Ukraine War Update: Major Russian Offensive is Expected This Summer Despite U.S. Military Aid

May 8, 2024 12:06 PM UTC

Bottom Line: The offensives at the front lines started to pick up steam after March/April as the Russian forces plan for their larger summer 2024 offensive operation, aiming to seize more territory before the U.S. presidential elections in November. In the meantime, U.S. approved a $61 billion warti

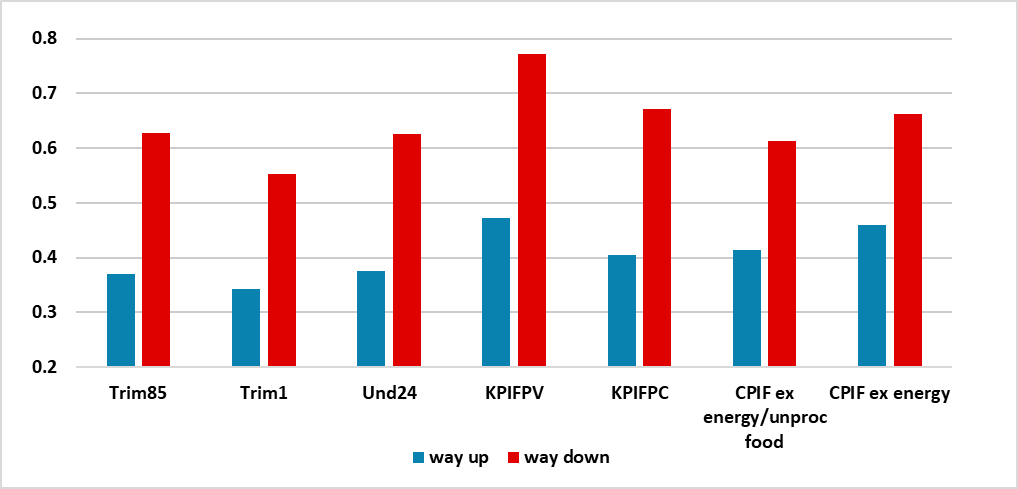

Sweden Riksbank Review: Biting the Bullet

May 8, 2024 8:24 AM UTC

It very much seemed to be a question of when, not if, as far as policy easing is concerned for the Riksbank. In this regard, albeit surprising in terms of timing, the Riksbank delivered, cutting its policy rate by 25 bp (to 3.75%), despite clear concerns it has flagged about recent and continued k

May 07, 2024

U.S. Fiscal Problems: 2025 More Than 2024

May 7, 2024 1:10 PM UTC

Current real yields in the U.S. government bond market already large reflect the large government deficit trajectory. Even so, H1 2025 could see some extra fiscal tensions that add 30-40bps to 10yr U.S. Treasury yields as the post president election environment will either see a reelected Joe Bide

May 06, 2024

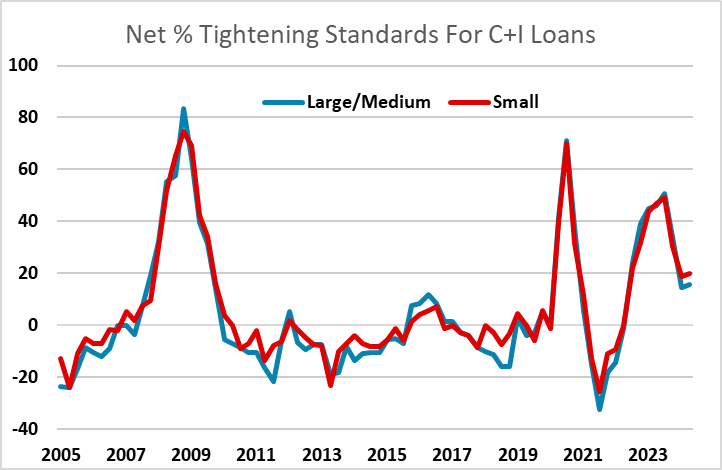

Fed SLOOS on Bank Lending mostly resilient

May 6, 2024 6:27 PM UTC

The Fed’s Q2 Senior Loan Officer Opinion Survey on bank lending practices generally sustains a less negative tone seen in the last survey for Q1, and does not suggest that the Fed need to have any serious concerns about the business investment outlook.

BCB Preview: 25bps or 50bps cut?

May 6, 2024 1:02 PM UTC

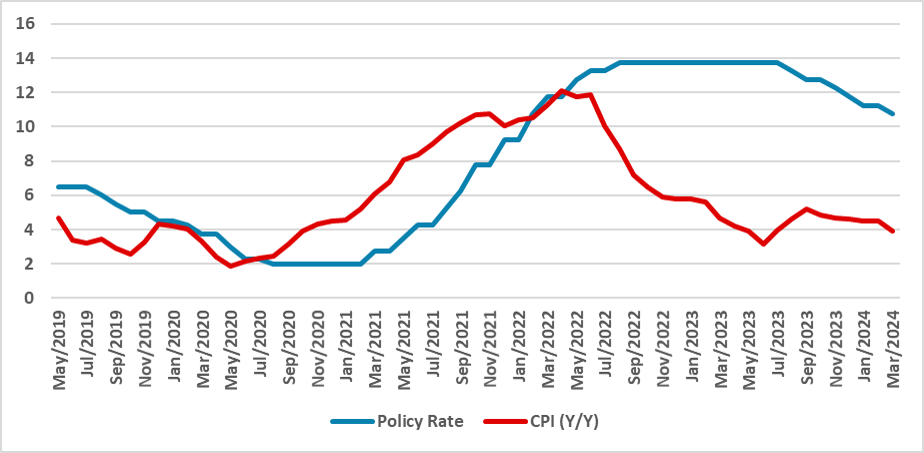

The Brazilian Central Bank (BCB) convenes on May 8 to set the policy rate. Previous forward guidance hinted at a 50bps cut in May, but recent statements from BCB President Roberto and some weakness in the BRL have shifted expectations to a 25bps cut. However, we anticipate the BCB maintaining a 50bp

May 05, 2024

May 03, 2024

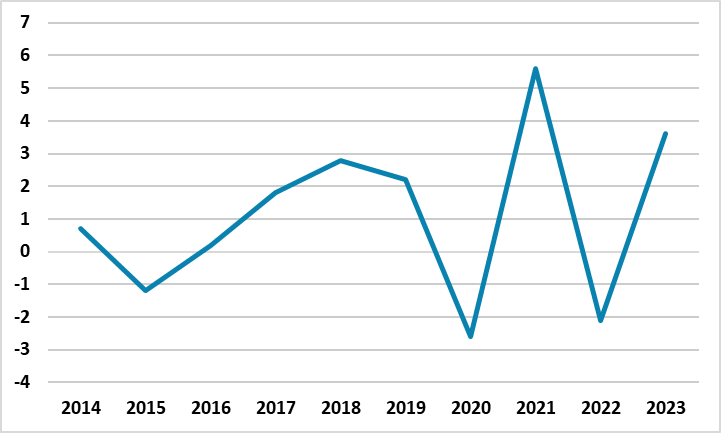

Russian Economy Expands by 4.2% YoY in March, and 5.4% in Q1

May 3, 2024 2:14 PM UTC

Bottom Line: According to the figures announced by the Russian Ministry of Economic Development, Russia's GDP grew by 4.2% YoY in March owing to strong fiscal stimulus, high military spending, invigorating consumer demand and investments. We now foresee Russian economy will expand by 2.6% in 2024

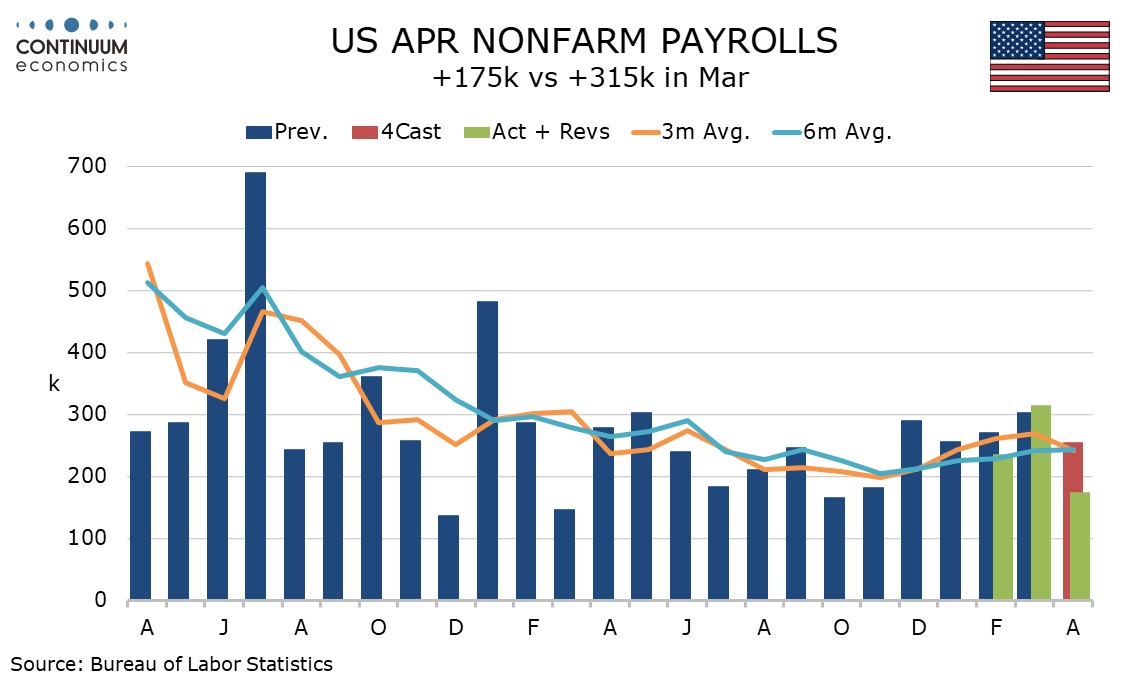

U.S. April Employment - On the weak side in all key details, following strength in March

May 3, 2024 1:18 PM UTC

April’s non-farm payroll is on the low side of consensus across the board, with a 175k increase (though the 167k private sector rise is only modestly below consensus), with a 0.2% rise in average hourly earnings, a fall in the workweek and a rise in unemployment to 3.9% from 3.8%. The data should

FX Daily Strategy: N America, May 3rd

May 3, 2024 9:04 AM UTC

USD to get support from US employment report

ISM services should be neutral, but some downside risks

JPY strength to continue long run, but some consolidation may be seen near term

NOK has upside scope despite recent weakness with Norges Bank likely to remain steady

FX Daily Strategy: Europe, May 3rd

May 3, 2024 5:57 AM UTC

USD to get support from US employment report

ISM services should be neutral, but some downside risks

JPY strength to continue long run, but some consolidation may be seen near term

NOK has upside scope despite recent weakness with Norges Bank likely to remain steady

May 02, 2024

FX Daily Strategy: Asia, May 3rd

May 2, 2024 9:00 PM UTC

USD to get support from US employment report

ISM services should be neutral, but some downside risks

JPY strength to continue long run, but some consolidation may be seen near term

NOK has upside scope despite recent weakness with Norges Bank likely to remain steady

FX Daily Strategy: APAC, May 3rd

May 2, 2024 3:12 PM UTC

USD to get support from US employment report

ISM services should be neutral, but some downside risks

JPY strength to continue long run, but some consolidation may be seen near term

NOK has upside scope despite recent weakness with Norges Bank likely to remain steady

Moody’s Improves Outlook Perspective Due to Higher Growth

May 2, 2024 2:27 PM UTC

Moody’s upgraded Brazil's outlook to positive from stable, maintaining its Ba2 rating, signaling a potential move to Ba1 soon. Strong growth prospects, attributed to institutional reforms, drove this shift. Despite lingering doubts, improved fiscal conditions and anticipated tax reform are bolster

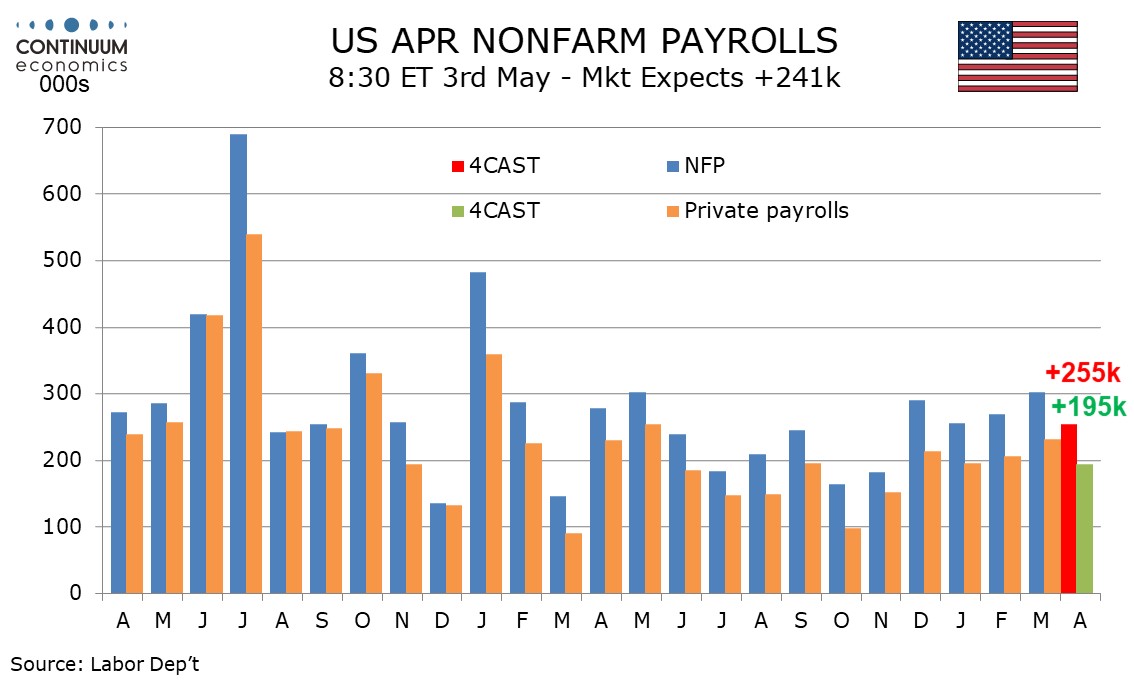

Preview: Due May 3 - U.S. April Employment (Non-Farm Payrolls) - Still strong if a little less so, earnings may be above trend

May 2, 2024 2:03 PM UTC

We expect a 255k increase in April’s non-farm payroll, still strong if the slowest since November, with a 195k increase in the private sector. We expect an unchanged unemployment rate of 3.8% and a slightly above trend 0.4% increase in average hourly earnings, lifted by a minimum wage hike in Cali

China Politburo: Help for Housing, But No Game changers

May 2, 2024 10:50 AM UTC

Politburo statement in late April suggests extra support for residential property. However, we see this as being incremental rather than any game changers and we still see residential investment remaining a negative drag on 2024 GDP growth.